Some Highlights

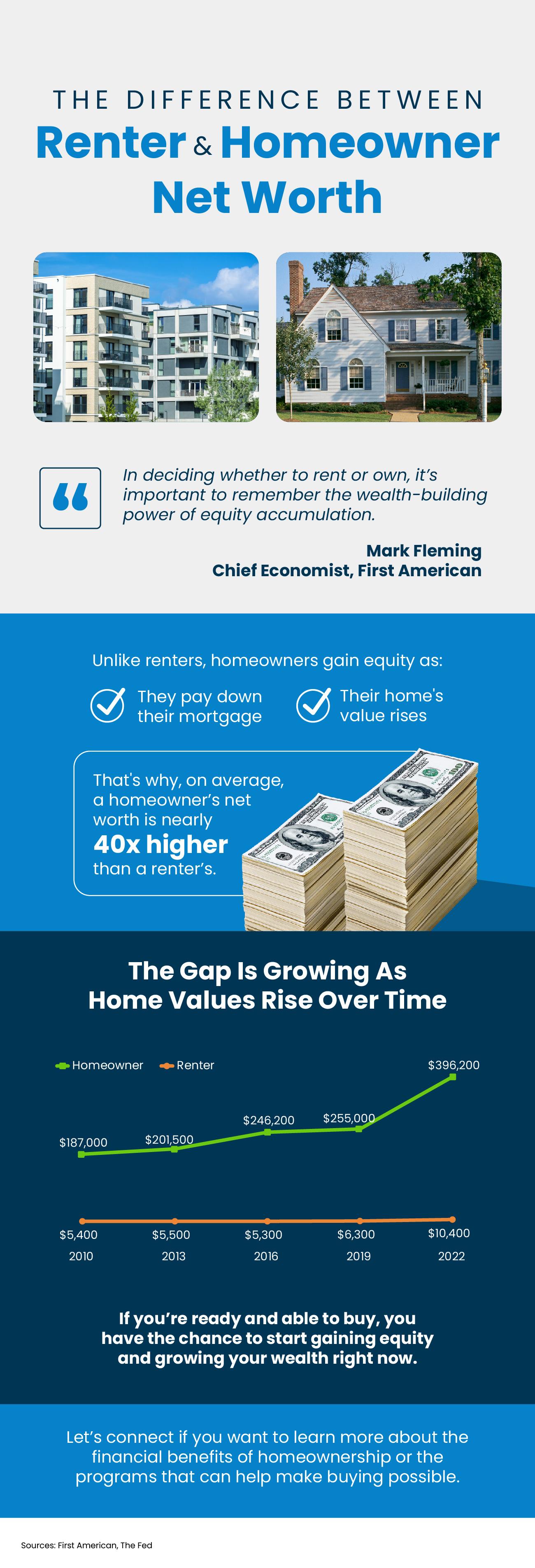

- If you’re torn between renting or buying, don’t forget to factor in the wealth-building power of homeownership.

- Unlike renters, homeowners gain equity as they pay their mortgage and as home values rise. That’s why, on average, a homeowner’s net worth is nearly 40x higher than a renter’s.

- Connect with an agent if you want to learn more about the financial benefits of homeownership or the programs that can help make buying possible.