If you’ve been skipping over newly built homes in your search, you might be doing so based on outdated assumptions. Let’s clear up a few of the most common myths, so you don’t miss out on a solid opportunity.

Myth 1: New Homes Are More Expensive

It’s easy to assume a new build will cost more than an existing home, but that’s not necessarily true, especially right now.

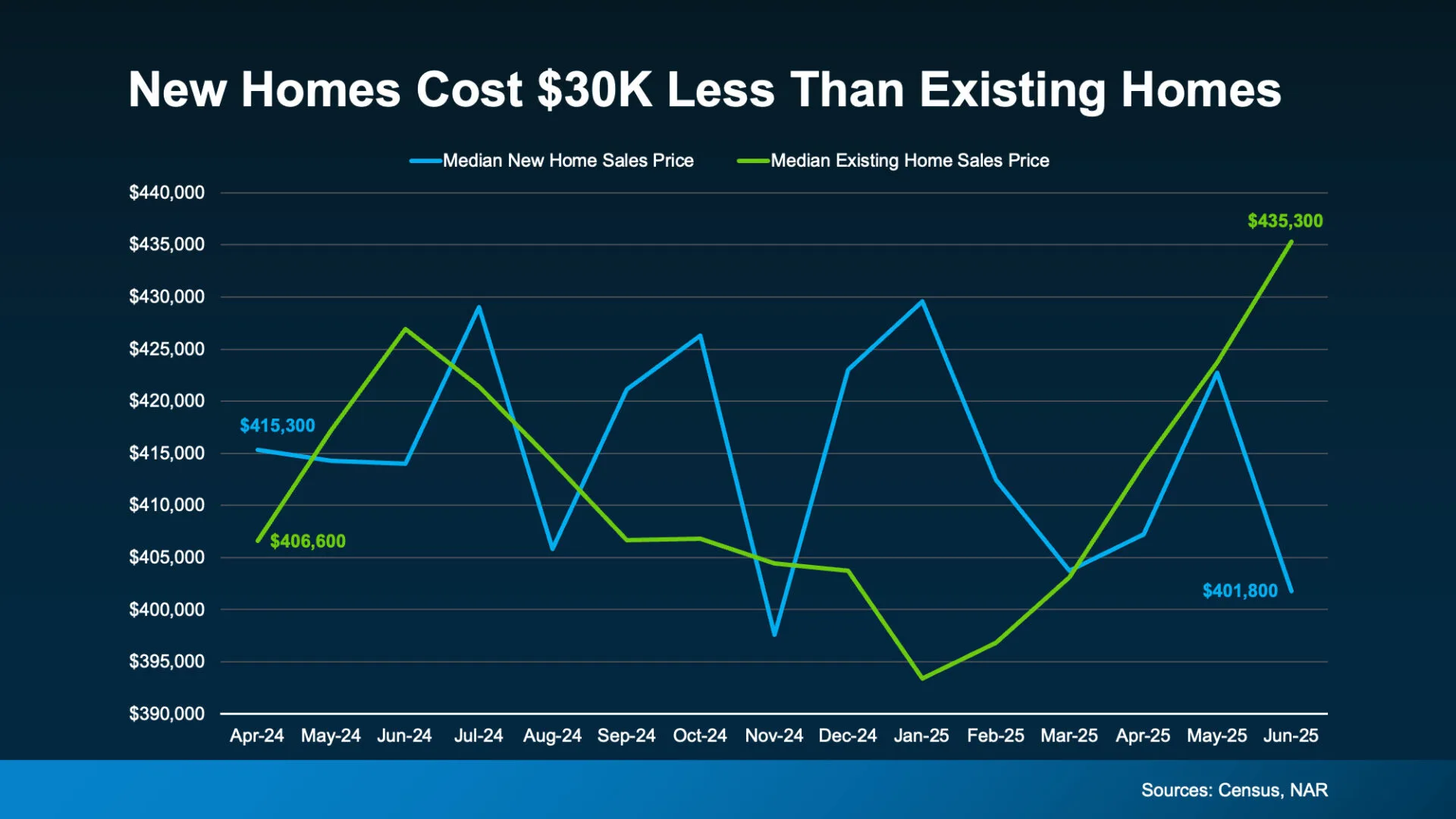

Data from Census and the National Association of Realtors (NAR) shows the median price of a newly built home today is actually lower than a home that’s been lived in already (an existing home):

So, why’s this happening? As Heather Long, Chief Economist at Navy Federal Credit Union, explains:

So, why’s this happening? As Heather Long, Chief Economist at Navy Federal Credit Union, explains:

“This largely reflects two trends: New homes are getting smaller on average, and builders are doing more price cuts.”

If you’ve ruled out new construction based on price alone, it’s time to take another look. Talk to your local real estate agent to see what’s available (and at what price points).

Myth 2: Builders Don’t Negotiate

Many buyers assume builders aren’t going to play ball when it comes time to negotiate. But that’s just not the case. A number of builders are sitting on finished inventory they want to sell quickly. And that makes them more open to compromising. Mark Fleming, Chief Economist at First American, explains a builder:

“. . . would love to sell you the home because they’re not living in it. It costs money not to sell the home. And many of the public home builders have said in their earnings calls that they are not going to be pulling back on incentives, especially the mortgage rate buydown . . .”

That means you may find builders more flexible than individual sellers, and more motivated to toss in incentives to get the deal done. According to Zonda, 75% of new home communities offered incentives on new homes considered quick move-ins in June.

Myth 3: They Don’t Build Them Like They Used To

Some people think newer homes lack the craftsmanship of older ones. But here’s a reality check. Quality can vary in any era. And using a reputable builder matters more than the build date.

According to the National Association of Home Builders (NAHB), a good way to gauge quality is by talking to buyers who have purchased from that builder recently. In an article, NAHB explains:

“Any high-quality builder should be ready to provide you with the names and phone numbers of satisfied customers. If they cannot, consider that a red flag and walk away.”

The article suggests asking those buyers questions like:

- Did the builder meet their expectations?

- Would you use that same builder, if you were to do it again?

But you can also ask your agent about the builder’s reputation. Generally, agents know about the builders active in your area and may even have experience with past clients who have bought a home in one of that builder’s communities.

Myth 4: You Don’t Need Your Own Real Estate Agent

This might be the biggest myth of all. The truth is, when you buy a brand-new home, using your own agent is even more important. Builder contracts have different fine print, and you’ll want a pro on your side who can really explain what you’re signing and advocate for your best interests.

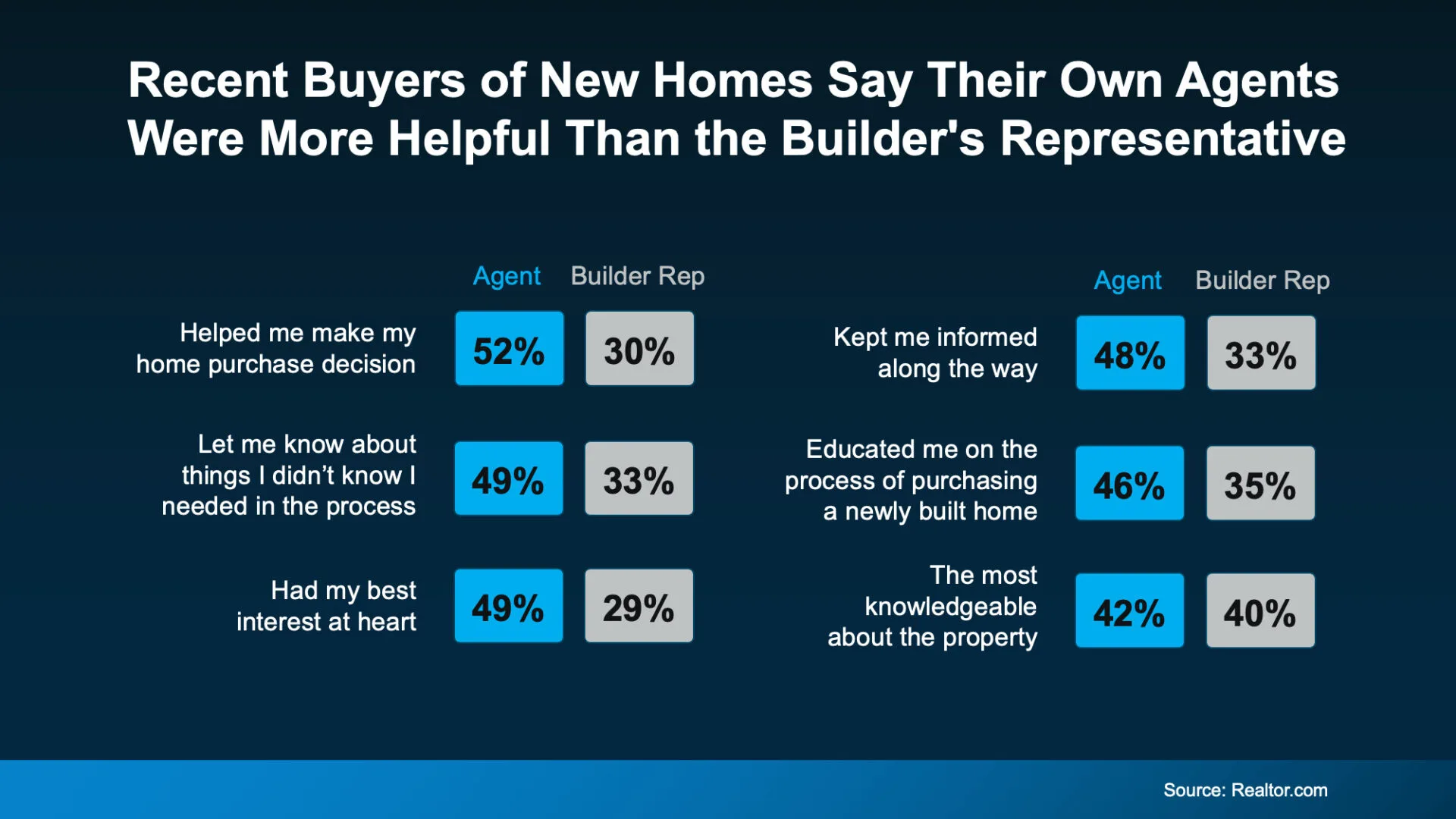

These stats seem to prove that’s the case. In a Realtor.com survey, buyers who purchased a newly built home rated their agents far more helpful than the builder (or the builder’s representative) during the process (see visual below):

Bottom Line

Don’t let misconceptions keep you from exploring one of the most promising options in today’s housing market.

Whether you’re curious about what’s being built nearby or wondering if a new home fits your budget, connect with a local agent. You might be surprised by what’s out there.