Some Highlights

- Once your offer is accepted, an inspector will assess the condition of the house, including things like the roof, foundation, plumbing, and more.

- That information is incredibly important and paves the way for you to re-negotiate with the seller, as needed. So, you don’t want to skip this step.

- An inspection is your chance to avoid costly headaches and get peace of mind. Connect with an agent to talk about other ways to make your offer stand out.

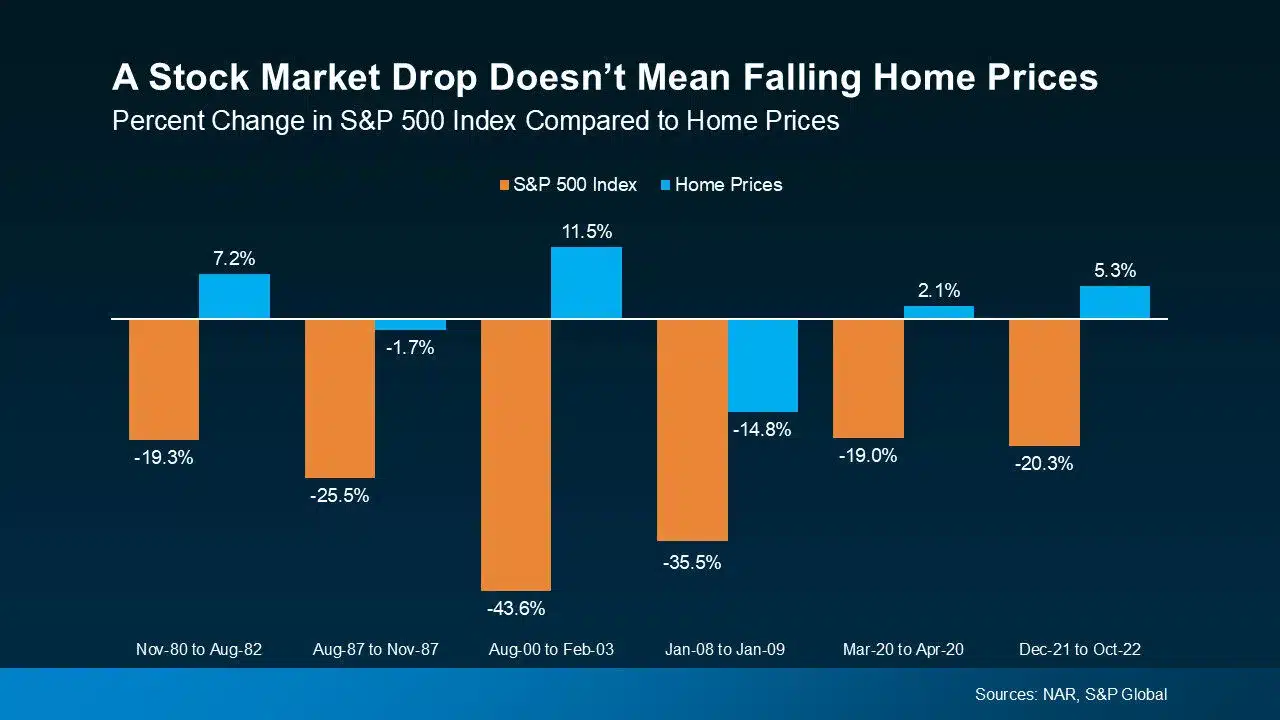

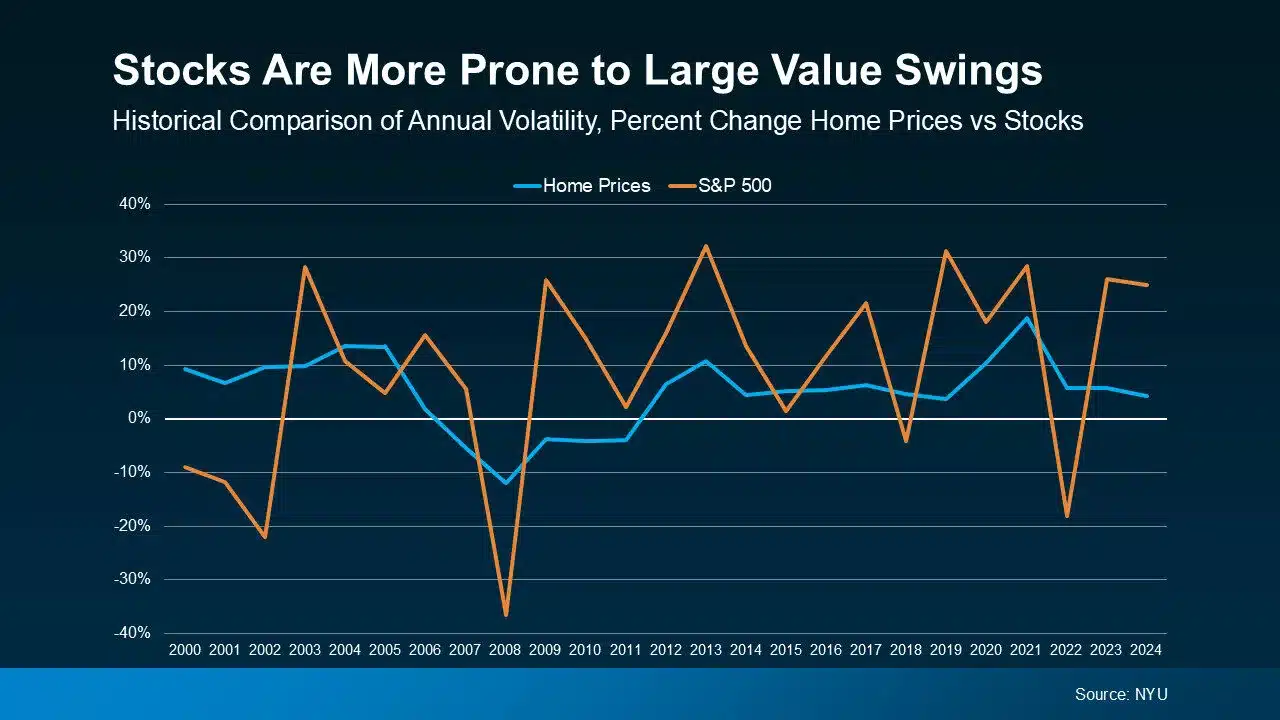

Even when the stock market falls more substantially, home prices don’t always come down with it.

Even when the stock market falls more substantially, home prices don’t always come down with it.

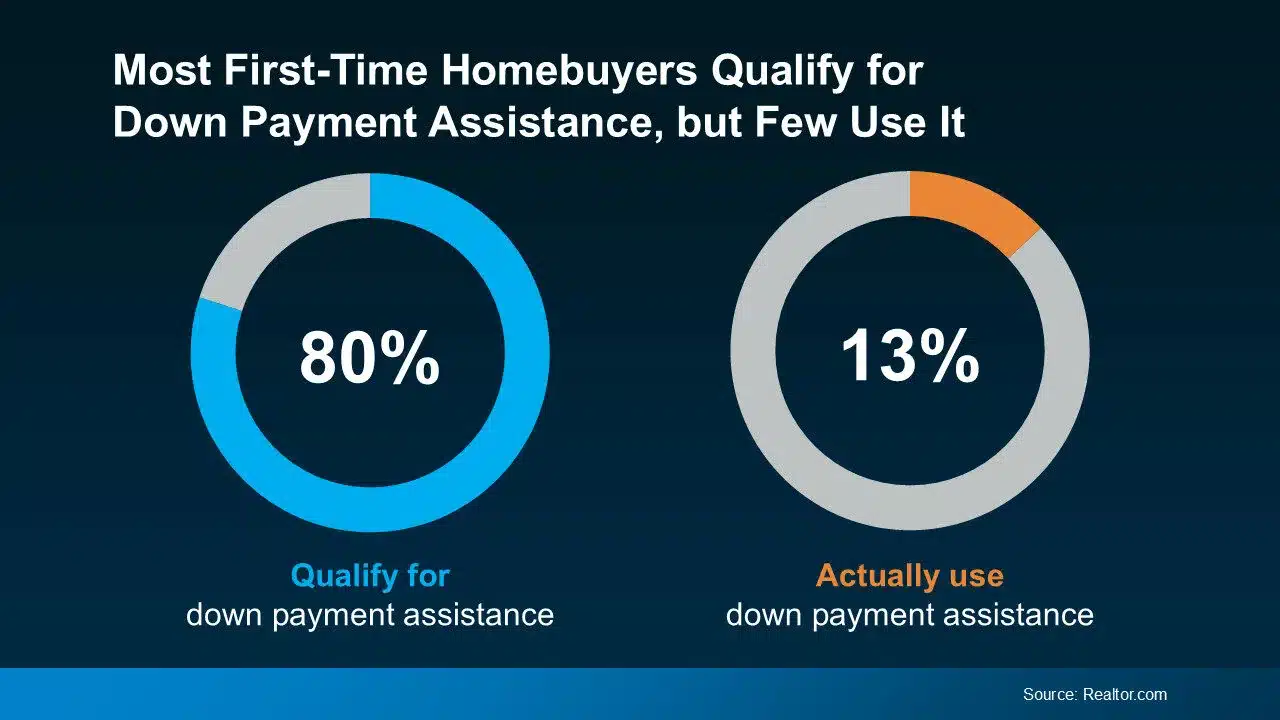

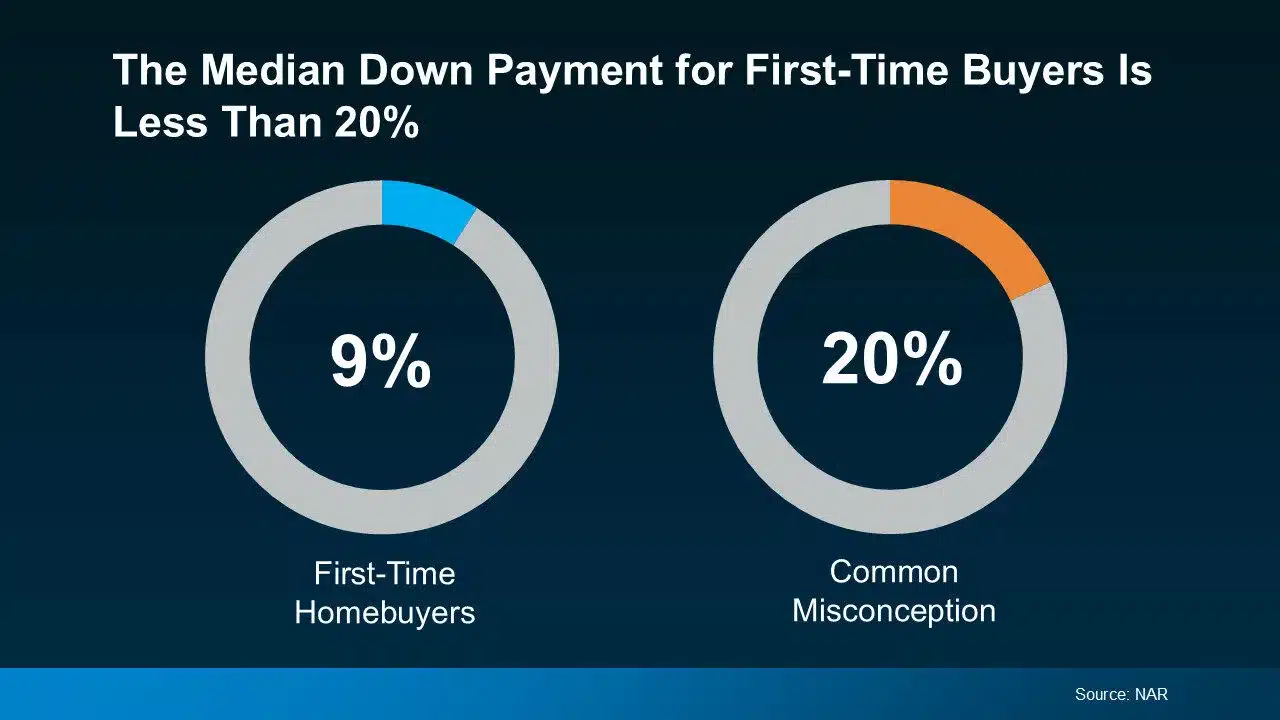

The takeaway? You may not need to save as much as you originally thought.

The takeaway? You may not need to save as much as you originally thought.