Some Highlights

- If you put your home search on hold because you couldn’t find anything you liked in your budget, it’s time to try again.

- There’s a much wider selection of homes for sale, with more fresh listings hitting the market each month.

- With more options come more possibilities. Connect with an agent if you want to see what’s available in your area.

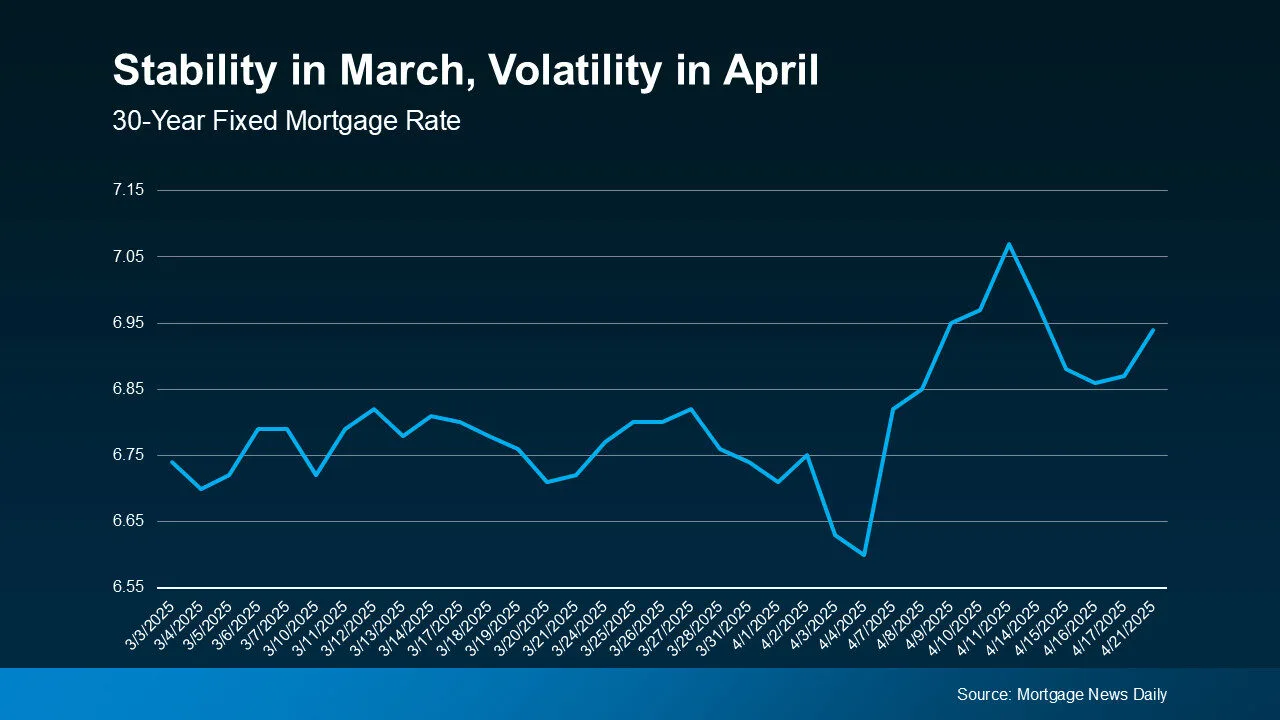

This kind of up-and-down volatility is expected when economic changes are happening.

This kind of up-and-down volatility is expected when economic changes are happening.