Even with more homes on the market right now, some buyers are still having a tough time finding the right one at the right price. Maybe the layout feels off. Maybe it still needs some updating. Or maybe it’s just more of the same.

That’s why more buyers are turning to new construction – and finding some of the best deals available today.

Why? Today, many builders have more homes that are finished and sitting on the market than normal. And that means they’re motivated to sell. They’re running a business, and they don’t want to sit on their inventory. They want to sell it before they build more homes. And that can definitely work in your favor.

As Lance Lambert, Co-Founder of ResiClub, puts it:

“In housing markets where unsold completed inventory has built up, many homebuilders have pulled back on their spec builds—and many are doing bigger incentives or outright price cuts to move unsold inventory.”

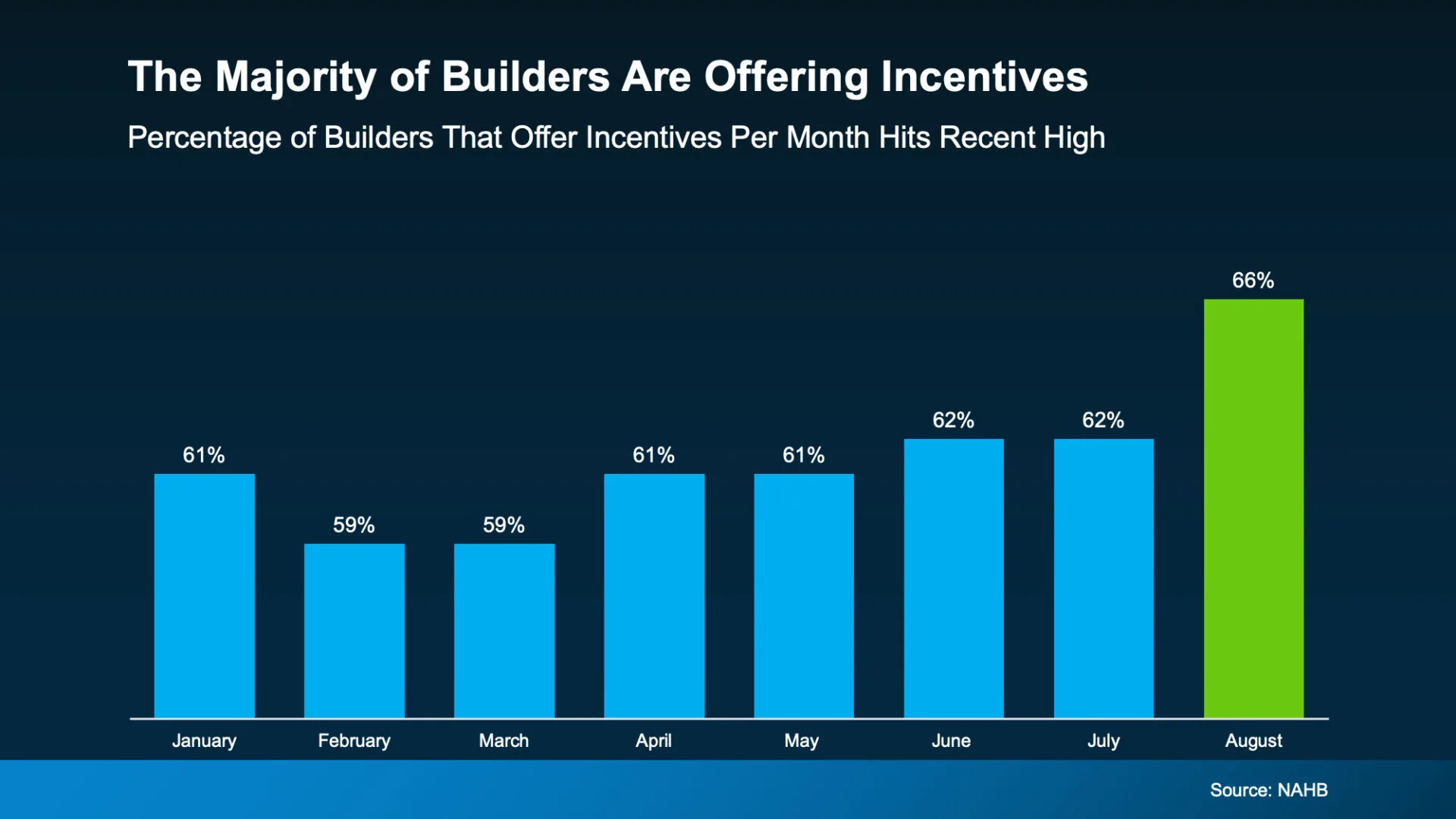

Incentives Are the Highest They’ve Been in 5 Years

Data from the National Association of Home Builders (NAHB) shows 66% of builders offered sales incentives in August. That’s the peak so far this year, and the highest percentage we’ve seen in 5 years.

That means 2 out of every 3 builders are offering something extra to get deals done. And when builders throw in incentives, it’s the buyers like you who win.

That means 2 out of every 3 builders are offering something extra to get deals done. And when builders throw in incentives, it’s the buyers like you who win.

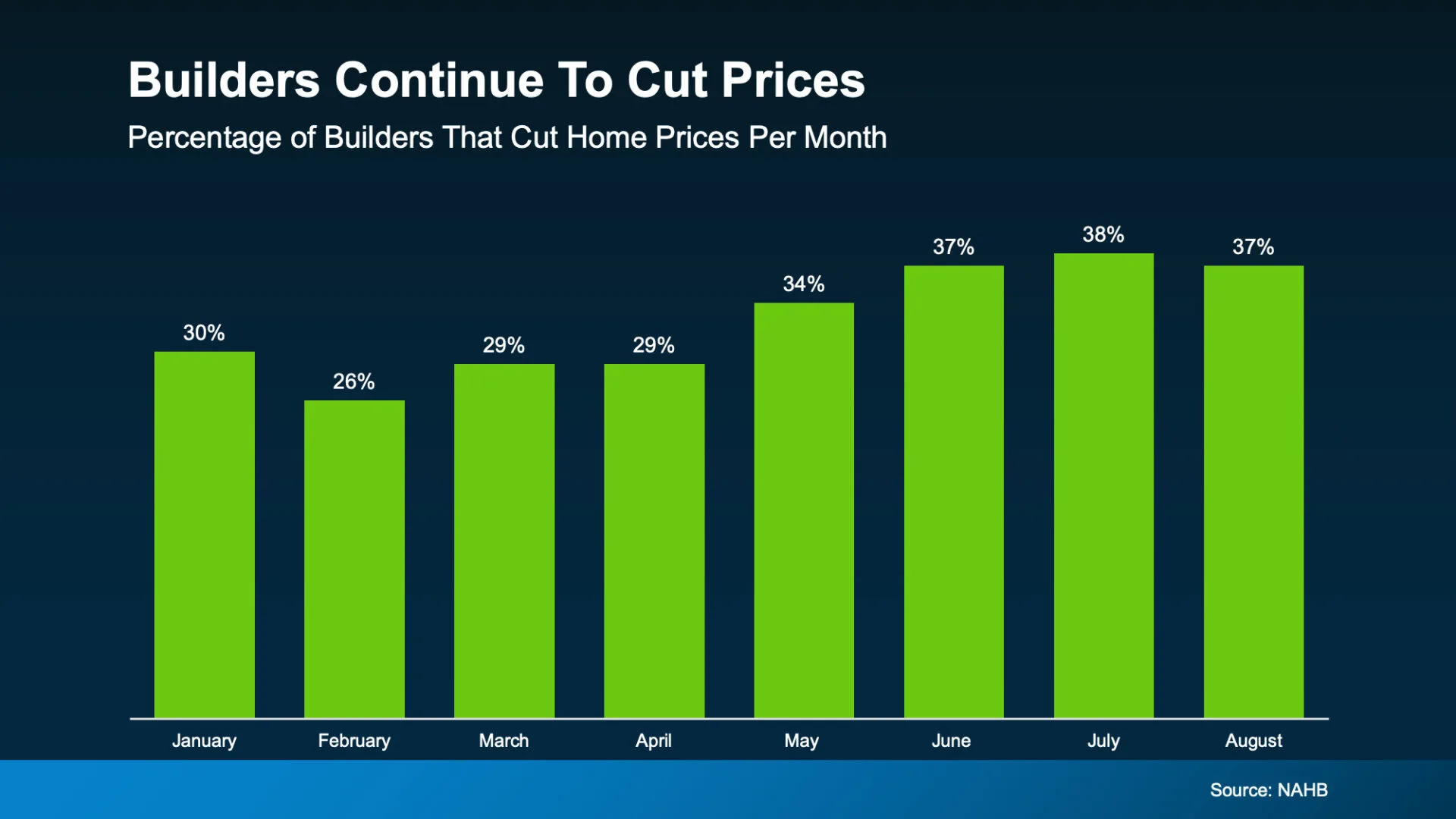

Price Cuts Are Back on the Table

One of the most common incentives they’re offering right now is adjusting the price. According to NAHB, almost 40% of builders are doing price cuts (see graph below):

On average they’re taking off about 5% off the purchase price of the house. For a buyer, 5% could be the difference between reluctantly settling and finally getting a home that works for you.

On average they’re taking off about 5% off the purchase price of the house. For a buyer, 5% could be the difference between reluctantly settling and finally getting a home that works for you.

Take a $500,000 house as an example. If builders reduce the price by 5%, you’re saving $25,000.

And even if the builder you’re interested in won’t budge on price, they’ve got plenty of other levers to pull. As Realtor.com explains:

“. . . there are deals to be found in the market for new homes, with builders increasingly willing to negotiate on price or offer incentives such as rate buydowns and closing cost assistance.”

Why This Matters for You

As a buyer, you probably have a clear vision for your ideal home. Because you’re not just buying any house. You’re buying your house. The one with the space, features, and lifestyle you’ve been hoping for. New builds can check those boxes since they usually have:

- Bigger kitchens and open layouts

- Energy efficiency (hello lower utility bills)

- Smart-home upgrades

- Fewer repair headaches on day one

And today’s incentives make buying a new home more attainable than it’s been in years.

One Word of Advice: Don’t Go At It Alone

If you want to take advantage of this opportunity, just be sure to use your own agent. Builder reps aren’t there to save you money. They protect the builder’s bottom line. That’s why you need to bring your agent with you. Your agent will:

- Cut through the sales pitch and run the cold hard numbers

- Spot which incentives are actually worth it (and which ones are fluff)

- Handle negotiations so you walk away with the best deal possible

- Keep your best interest as their top priority

Bottom Line

If you’re not finding a home you love, the new home market is buzzing with opportunity. With record-high incentives, price cuts in play, and builders itching to move inventory, this is the best time in years to buy new construction.

Curious how far today’s incentives could stretch your budget? Connect with an agent to see what builders are offering in your area.