Homebuyers are watching the economy closely, and for good reason. Buying a home is one of the biggest purchases most people ever make. And some recession talk in the media has made a lot of would-be buyers second guess their plans.

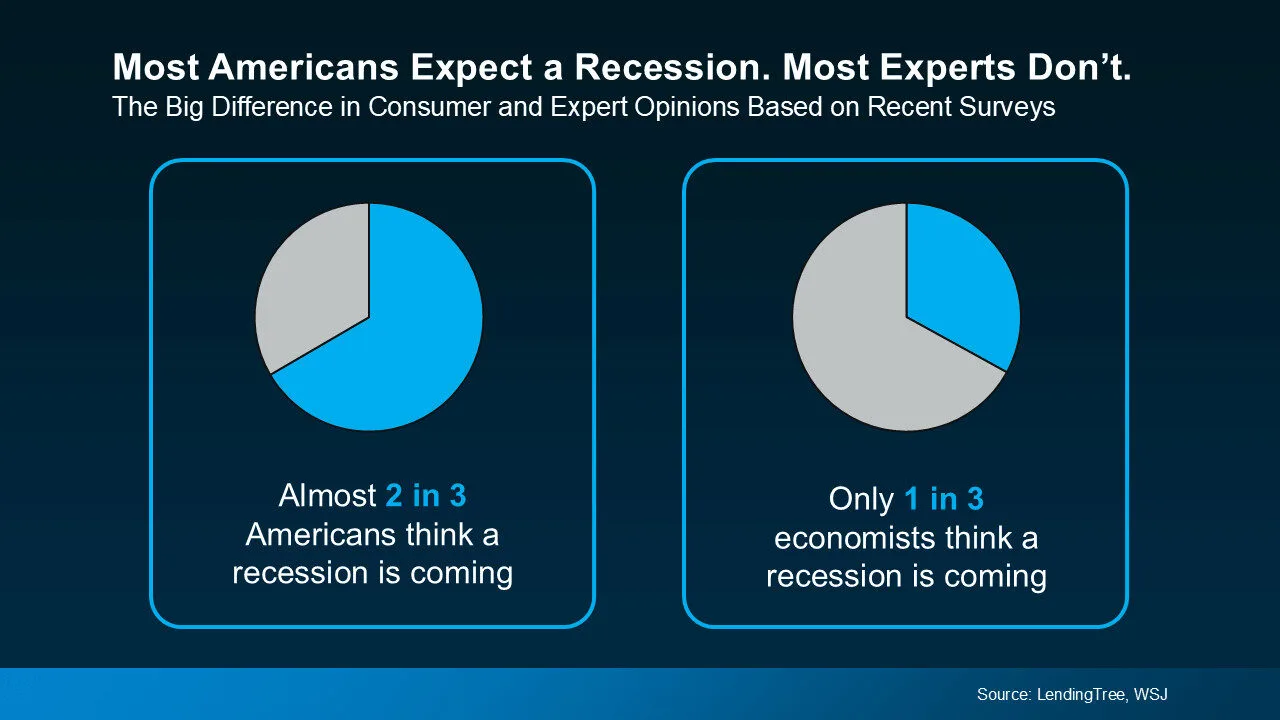

In the latest LendingTree survey, almost 2 in 3 Americans said they think a recession is coming. And 74% of respondents say that’s having an impact on their financial decisions.

But here’s the good news: the experts aren’t nearly as concerned.

Most Americans Expect a Recession, But Most Experts Don’t

According to an October report from the Wall Street Journal (WSJ), only 1 in 3 experts surveyed say we may be headed for a recession sometime in the next 12 months (see graph below):

If the expert economists aren’t super worried, should you be? We’re not in a recession right now. And there’s no guarantee we’re heading into one.

If the expert economists aren’t super worried, should you be? We’re not in a recession right now. And there’s no guarantee we’re heading into one.

What we do have is uncertainty – and the best way to handle that is by leaning on facts, not fear. You can do that by making sure you have the information you need to make an informed decision.

Tips for Buying a Home During Periods of Economic Uncertainty

Here’s the best advice anyone can give right now. While it’s important to keep an eye on what’s happening in the economy, that shouldn’t necessarily overshadow your real-life needs. Economic shifts come and go, but the reasons people buy homes rarely change. Danielle Hale, Chief Economist at Realtor.com, explains:

“Well-prepared buyers who have been waiting on the sidelines are likely motivated by personal and lifestyle needs like growing families, new jobs, or retirement. And these considerations can outweigh short-term economic uncertainties . . . ”

Timing your move around real life (not the news cycle) is what matters most.

But here’s the key. If you’re going to buy a home right now, job stability really matters. You need to feel confident in your income and know you can comfortably manage your mortgage payments, even if your situation or the economy shift.

If your job is secure and you’ve built a cushion of savings, experts say you don’t necessarily need to delay. Just keep these tips from the economists at Redfin in mind:

- Set a budget and stick to it: Don’t overextend. Make sure your payments are affordable and your savings can cover any surprises. This includes factoring in costs likely to rise, like home insurance and taxes.

- Negotiate: There are more homes for sale right now, and other buyers may pull back because of their own fears. That gives you more negotiating power when working with sellers. Use it to get the best deal possible.

- Be strategic about payments and mortgage rates: Talk to lenders about what payment you can afford and the rate you can qualify for today, as well as your options if rates go down later on.

- Consider selling before you buy: If you already own a home, selling first can reduce the financial pressure and help solidify your budget for your next home.

But nothing replaces the value of having a trusted team around you, especially right now. As Bankrate says:

“Buying a home during a recession can sometimes be a good idea – but only for people who are lucky enough to remain financially stable . . . Be sure to enlist the help of an experienced local real estate agent. Not only do agents know their markets well, they will also work to get you the best deal in any given situation, including a recession.”

Bottom Line

Most Americans think a recession is coming. But most experts don’t.

So, you don’t necessarily have to put your moving plans on hold. If your finances are solid, your job is stable, and you have a real need to move, you can still make this happen. You just need the right team of pros by your side.

What’s holding you back from making your next move? Connect with a local agent and lender to talk it over.