Some Highlights

- If you’re planning to list your house in 2025, it’s already time to start working on any repairs. But where do you start?

- Your local agent will be able to help you prioritize projects that will help you get the best return on your investment and appeal to what today’s buyers really want.

- If your goal is to sell your house next year, connect with an agent so you know what to start working on now.

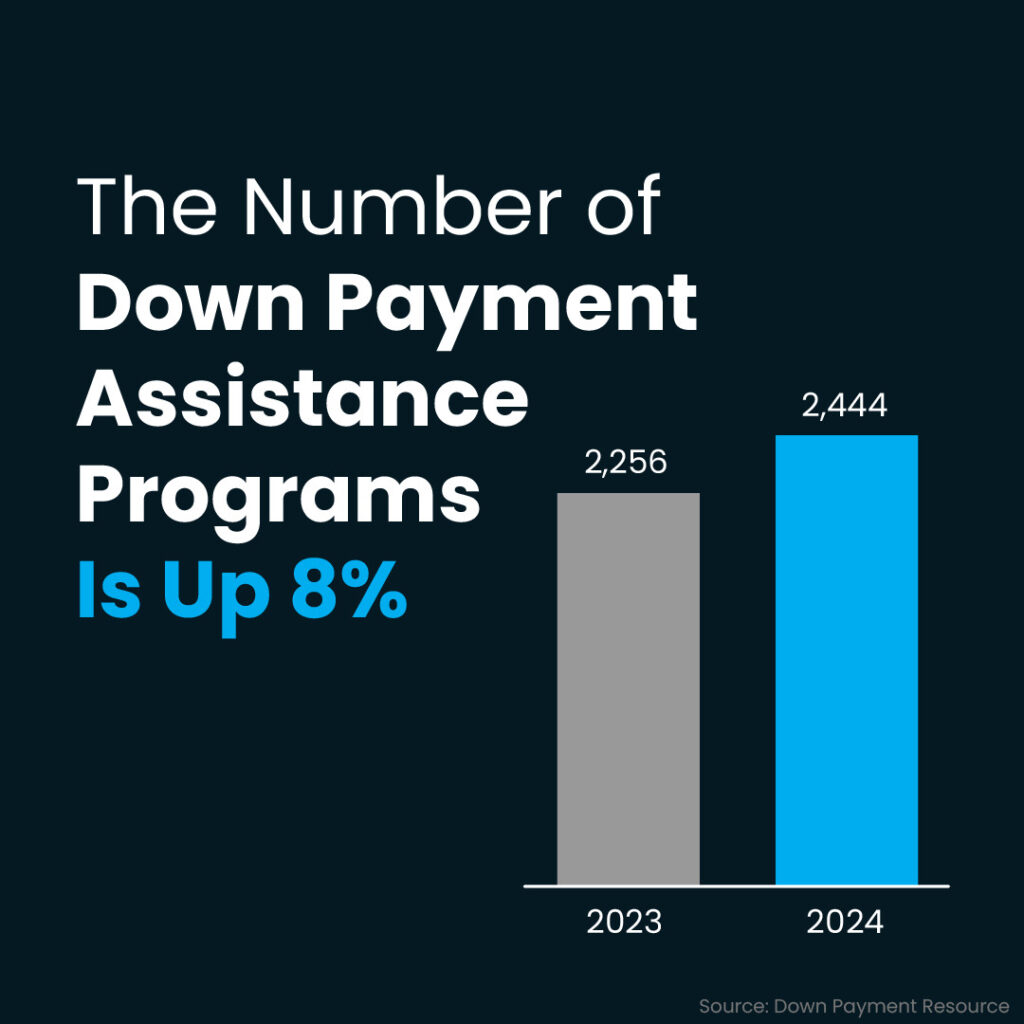

More Las Vegas Programs, More Opportunities for You

More Las Vegas Programs, More Opportunities for You